Usama Waheed

Part III: What’s it like to send Rs. 1000 in Pakistan?

Featuring Allied Bank, HBL Konnect, and Bank Alfalah

Part III: What’s it like to send Rs. 1000 in Pakistan?

Featuring Allied Bank, HBL Konnect, and Bank Alfalah

Usama Waheed

This is the second of our 4-part case study on the state of e-banking in Pakistan. We take a look at how easy it is to send money using 12 different apps.

? Tip: click the slides below to start. Use arrow keys to move around; or swipe if you're on a mobile device.

Full case study in slides above ?

Quick summary down below ?

The mobile experience is much better in fullscreen

Full case study in slides above ?

Quick summary down below ?

Key takeaways

I’ll highlight one issue with each of Allied Bank, HBL Konnect and Bank Alfalah below, but you can go through the full case studies in the slides above.

Allied Bank

ABL’s app is…functional. But there’s lots of inconsistencies in expectations.

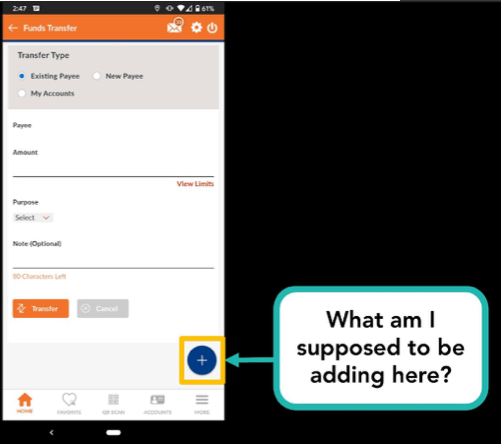

Take a look at the Transfer page, for example.

Here, the default option is ‘Existing Payee’ even though there are no existing payees.

There’s New Payee right next to it, which would be the logical next step. But then there’s a giant blue ‘+’ icon at the bottom; what does it do? Turns out it is for ‘Add Payee’ - which is different from ‘New Payee’.

In fact, you could be well on your way to adding a payee, before realizing that this process won’t actually result in sending money. To do that, you’d have to go back and start from ‘Existing Payee’ or ‘New Payee’.

These small issues with the UX writing are easy fixes that can reduce a lot of confusion.

HBL Konnect

HBL Konnect stands out for its aesthetics - but the usability leaves a lot to be desired.

The sign up process is easily one of the most awful experiences I’ve had in making this series of case studies. There’s a needlessly complicated OTP system that doesn’t work, and I’ll buy you a cupcake if you can set your password correctly in the first attempt.

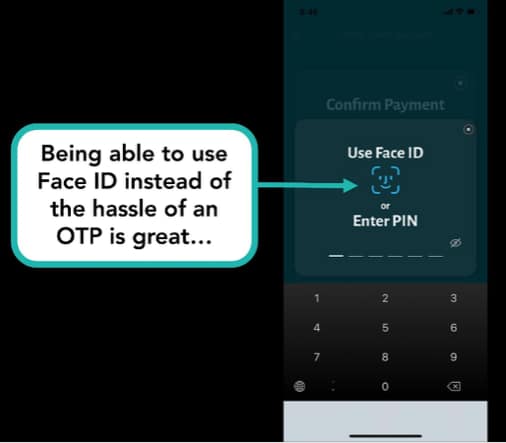

It is, however, one of the few apps that uses FaceID correctly, which is pretty convenient if you don’t want to deal with OTPs and passwords during every single transaction.

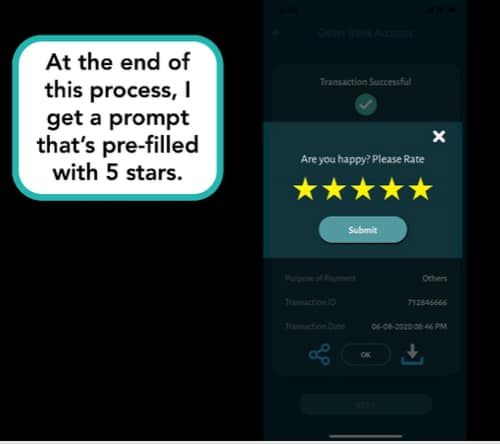

What really gets my goat, though, is this rating system:

Pre-filling it with 5 stars and hoping the user just taps ‘Submit’ to move on is designed to artificially inflate your ratings. I would not be surprised if the product manager’s performance evaluation relies on this rating. But dark patterns like these will deprive you of realistic feedback and the opportunity to improve.

Bank Alfalah

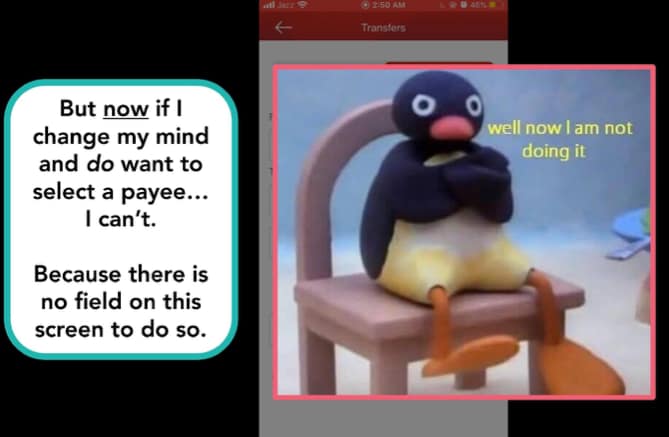

Bank Alfalah’s biggest problem is inconsistent menus.

You’ll get some menus where you wouldn’t expect them…and then if you want to bring them up again - you can’t.

Likewise, if you add a beneficiary, you can’t see it until the next time you log in.

And speaking of logging in: you get timed out after 5 minutes of inactivity - even if you have been actively filling out a form the entire time. Extremely infuriating.

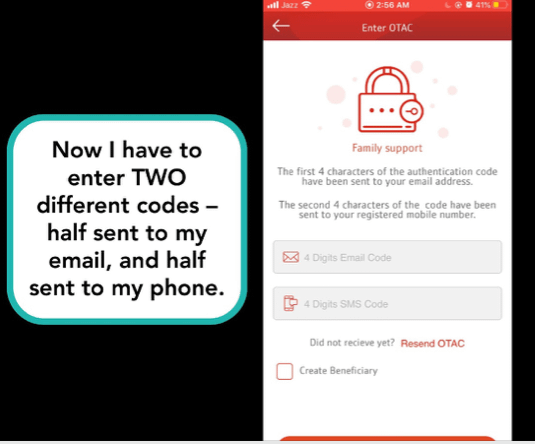

Like Standard Chartered, Bank Alfalah also requires two separate OTPs: one sent to your phone, and one sent to your email. This means it could be impossible to send money in a pinch if you don’t have phone signals, don’t have email set up on your phone, or if you’re abroad. Again, security is important, but if it locks you out of your own workflow, it’s not going to be of much help.

Want more? Follow us on Twitter, where we tweet about UX tidbits.

More case studies

Want to work together?

Quick links

Want to work together?